The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

9 Easy Facts About Stonewell Bookkeeping Shown

Table of ContentsThe Greatest Guide To Stonewell BookkeepingStonewell Bookkeeping Can Be Fun For AnyoneThe smart Trick of Stonewell Bookkeeping That Nobody is Discussing3 Simple Techniques For Stonewell Bookkeeping9 Simple Techniques For Stonewell Bookkeeping

Every company, from handcrafted cloth makers to game designers to dining establishment chains, gains and spends money. Bookkeepers assist you track all of it. What do they really do? It's difficult knowing all the solution to this inquiry if you have actually been only concentrated on expanding your company. You may not totally recognize and even start to totally value what a bookkeeper does.The background of bookkeeping dates back to the beginning of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants kept documents on clay tablet computers to keep accounts of transactions in remote cities. In colonial America, a Waste Schedule was commonly used in bookkeeping. It contained a day-to-day diary of every deal in the sequential order.

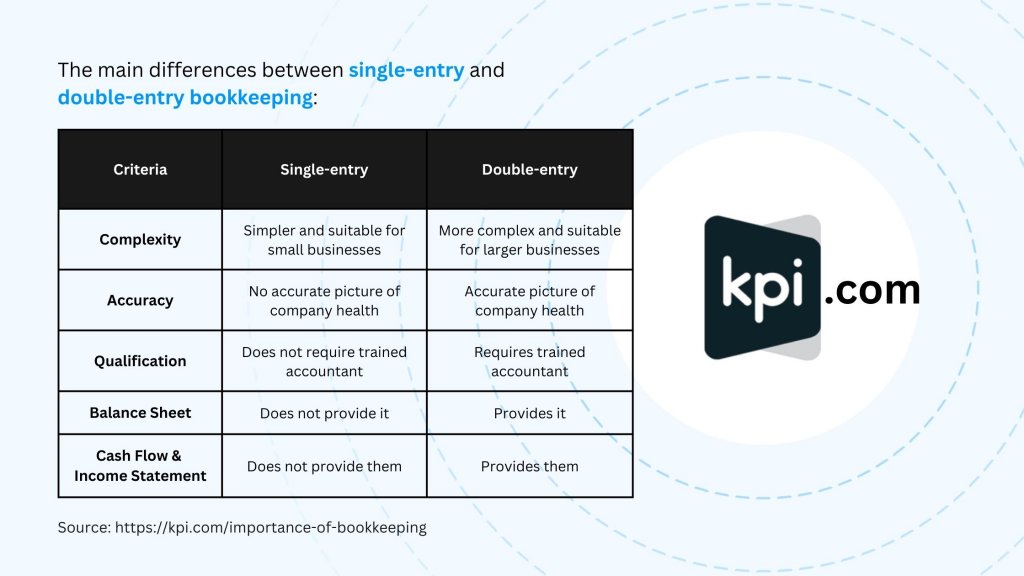

Small companies might depend only on a bookkeeper initially, however as they expand, having both specialists on board ends up being progressively useful. There are 2 primary kinds of bookkeeping: single-entry and double-entry accounting. documents one side of a financial transaction, such as adding $100 to your expense account when you make a $100 acquisition with your charge card.

4 Simple Techniques For Stonewell Bookkeeping

entails videotaping monetary transactions by hand or using spread sheets - bookkeeping services near me. While low-cost, it's time consuming and prone to mistakes. uses devices like Sage Cost Management. These systems instantly sync with your charge card networks to offer you bank card deal information in real-time, and instantly code all data around expenditures consisting of jobs, GL codes, areas, and classifications.

They ensure that all documents complies with tax obligation rules and policies. They monitor cash money flow and consistently produce monetary records that aid crucial decision-makers in a company to press the service ahead. In addition, some accountants additionally assist in maximizing pay-roll and invoice generation for an organization. A successful bookkeeper needs the following abilities: Accuracy is type in financial recordkeeping.

They usually start with a macro viewpoint, such as an annual report or an earnings and loss declaration, and afterwards drill into the details. Bookkeepers make sure that vendor and client records are constantly as much as date, even as people and businesses modification. They might additionally need to collaborate with other departments to make certain that every person is utilizing the same information.

Fascination About Stonewell Bookkeeping

Entering bills into the accounting system permits for accurate preparation and decision-making. This aids companies obtain payments quicker and boost money circulation.

Entail internal auditors and compare their counts with the tape-recorded values. Bookkeepers can function as consultants or in-house staff members, and their settlement varies depending on the nature of their employment.

That being claimed,. This variant is influenced by elements like location, experience, and ability degree. Consultants frequently charge by the hour but may provide flat-rate packages for specific jobs. According to the United States Bureau of Labor Stats, the typical bookkeeper salary in the USA is. Bear in mind that wages can vary depending on experience, education, location, and sector.

Some Known Details About Stonewell Bookkeeping

Several of the most usual documentation that organizations need to send to the federal government includesTransaction details Financial statementsTax compliance reportsCash flow reportsIf your bookkeeping is up to date all year, you can avoid a ton of stress throughout tax obligation period. Accounting. Patience and attention to information are key to far better accounting

Seasonality belongs of any kind of work in the world. For accountants, seasonality suggests durations when payments come flying in with the roofing system, where having outstanding job can come to be a major blocker. It ends up being essential to expect these moments ahead of time and to complete any kind of stockpile prior to the stress duration hits.

Stonewell Bookkeeping - Truths

Avoiding this will minimize the threat of activating an IRS audit as it gives an accurate depiction of your financial resources. Some usual to keep your personal and organization financial resources different areUsing a company bank card for all your service expensesHaving separate checking accountsKeeping receipts for personal and organization expenses separate Think of a globe where your site accounting is done for you.

Workers can respond to this message with an image of the invoice, and it will automatically match it for you! Sage Cost Monitoring provides very customizable two-way assimilations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These assimilations are self-serve and require no coding. It can automatically import information such as staff members, projects, groups, GL codes, departments, task codes, price codes, tax obligations, and extra, while exporting costs as bills, journal entrances, or charge card costs in real-time.

Take into consideration the complying with pointers: An accountant that has dealt with organizations in your market will much better comprehend your details needs. Qualifications like those from AIPB or NACPB can be an indication of trustworthiness and capability. Request for references or inspect on-line testimonials to guarantee you're employing somebody trusted. is a fantastic location to begin.